Planning a trip can be exciting, but unforeseen events can quickly turn it into a stressful experience. From lost luggage and flight cancellations to medical emergencies abroad, travel disruptions can lead to significant financial losses. Travel insurance offers a safety net against these potential problems, providing financial protection and peace of mind. But is travel insurance truly worth the cost? This article will delve into the benefits and drawbacks of travel insurance, helping you determine whether this crucial coverage is right for your next adventure. We’ll explore different travel insurance policies, coverage options, and factors to consider when making your decision.

Navigating the world of travel insurance can be complex. Understanding what is covered and excluded is essential for making an informed choice. This article will analyze various travel insurance scenarios, examining situations where travel insurance can prove invaluable and when it might not be necessary. We’ll dissect common travel insurance claims, discuss policy limitations, and offer tips for selecting the best travel insurance plan to suit your individual needs and budget. By the end of this article, you’ll be equipped with the knowledge to confidently determine whether travel insurance is a worthwhile investment for your upcoming travels.

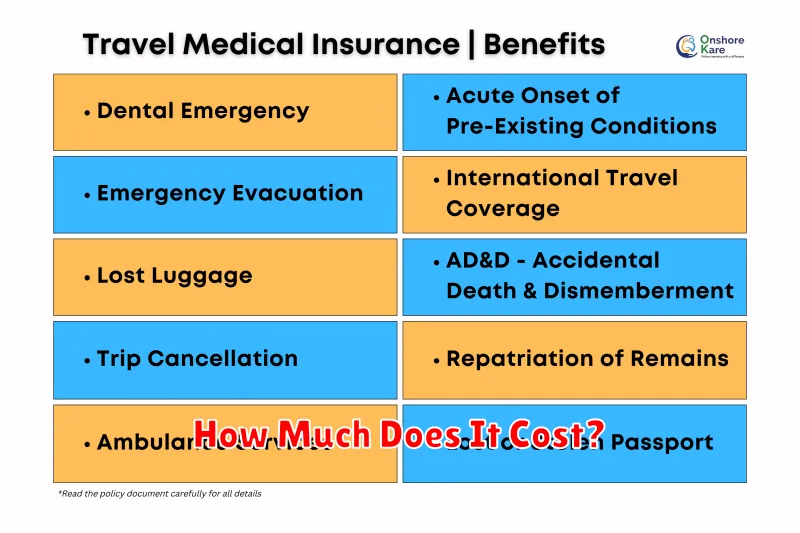

What Travel Insurance Typically Covers

Travel insurance policies vary, but most offer a range of protections for common travel mishaps. Trip cancellations are often covered due to unforeseen circumstances like illness, severe weather, or natural disasters. This coverage usually reimburses prepaid, non-refundable trip expenses.

Trip interruptions are also frequently covered, providing reimbursement for the unused portion of a trip if you must return home early due to a covered reason. Medical emergencies abroad can be costly, and travel insurance can help with expenses related to hospital stays, doctor visits, and emergency medical evacuations.

Many policies also cover lost, stolen, or damaged baggage, providing reimbursement for essential items if your luggage is delayed or goes missing. Some policies offer travel delay coverage, which can help with expenses incurred due to significant flight delays or cancellations, such as accommodation and meals.

Certain policies may also include 24/7 emergency assistance services. These services can help travelers with various needs, including locating medical facilities, replacing lost passports, and providing legal referrals.

It is crucial to read the policy details carefully to understand the specific coverage, limits, and exclusions before purchasing travel insurance.

Types of Travel Insurance Policies

Travel insurance policies come in various forms, each designed to cover specific needs and situations. Understanding these different types is crucial for selecting the right coverage for your trip.

Single Trip policies cover one specific trip with defined start and end dates. This is a popular option for travelers taking one vacation or business trip.

Annual/Multi-Trip policies cover multiple trips within a year. This is often a cost-effective choice for frequent travelers.

Specialized travel insurance caters to specific activities or situations. Examples include adventure travel insurance for activities like skiing or scuba diving, and student travel insurance tailored for those studying abroad.

Within these broad categories, policies offer different levels of coverage. Medical coverage is a core component, focusing on emergency medical expenses and repatriation. Trip cancellation/interruption insurance reimburses prepaid, non-refundable trip costs if you need to cancel or cut your trip short due to covered reasons. Baggage coverage protects against lost, stolen, or damaged luggage.

Situations Where Insurance Saves You

Travel insurance can be a crucial safety net, offering financial protection and peace of mind in various unforeseen circumstances. Consider these scenarios where travel insurance proves its worth.

Medical Emergencies Abroad: Unexpected illness or injury requiring hospitalization or emergency medical evacuation can incur exorbitant costs. Travel insurance can cover these expenses, preventing a significant financial burden.

Trip Cancellations or Interruptions: Life throws curveballs. If you need to cancel or cut your trip short due to covered reasons like illness, severe weather, or family emergencies, travel insurance can reimburse prepaid, non-refundable trip costs.

Lost or Stolen Luggage: Losing your belongings can disrupt your trip and lead to unexpected replacement costs. Travel insurance can provide reimbursement for lost, stolen, or damaged luggage.

Emergency Evacuations: In cases of natural disasters, political unrest, or other emergencies requiring evacuation, travel insurance can cover the costs of getting you to safety.

Travel Delays: Significant flight delays can lead to additional expenses for accommodation, meals, and transportation. Travel insurance can offer reimbursement for these unforeseen costs.

When You Might Not Need It

While travel insurance offers valuable protection, there are situations where it might be redundant. If you’re embarking on a short, domestic trip and are comfortable assuming the financial risks associated with potential cancellations or minor medical emergencies, you might consider forgoing a policy. Especially if you have comprehensive health insurance that provides coverage while traveling within your country.

Another scenario where travel insurance might be unnecessary is if your credit card offers robust travel protection benefits. Some premium credit cards include trip cancellation/interruption insurance, baggage delay/loss insurance, and even emergency medical coverage when you book your trip using the card. Carefully review your card’s benefits guide to determine if the coverage is sufficient for your needs.

If you are traveling to a destination with a reciprocal healthcare agreement with your home country, you might already have access to essential medical services at reduced costs or even for free. Researching the specific terms of these agreements can help you decide whether supplemental travel insurance is warranted.

Finally, if your trip is considered low-risk and your primary concern is lost or delayed baggage, you could explore separate baggage insurance options, which are generally less expensive than a comprehensive travel insurance policy.

How Much Does It Cost?

The cost of travel insurance varies depending on several key factors. Trip cost is a significant factor, as more expensive trips generally require more coverage. Destination also plays a role, with trips to certain regions potentially costing more to insure due to higher risks. Your age is another important factor, as older travelers typically face higher premiums due to increased potential medical expenses. The length of your trip also influences the price, with longer trips requiring more coverage duration.

Coverage type is a critical factor. A basic plan covering lost baggage and trip cancellations will be less expensive than a comprehensive plan including medical evacuation and emergency medical care. The amount of coverage you choose also impacts the premium. Higher coverage limits result in higher premiums. Finally, any optional add-ons like adventure sports coverage or pre-existing condition waivers will increase the overall cost.

While it’s impossible to give a precise figure without specific details, travel insurance typically costs between 4% and 10% of your total trip cost. Getting quotes from multiple insurers is essential to ensure you’re receiving the best possible price for the coverage you need.

How to Choose the Right Policy

Selecting the right travel insurance policy requires careful consideration of your individual needs and the specifics of your trip. Coverage amounts should align with potential expenses, including medical care, emergency evacuation, and lost luggage. Consider the destination and the associated risks. Some destinations necessitate higher medical coverage or specific protections. Activities planned during your trip, such as adventure sports, may require additional coverage often excluded from standard policies.

Policy length is another crucial factor. Single-trip policies are suitable for one specific journey, while multi-trip or annual policies cater to frequent travelers. Pre-existing conditions require special attention. Disclose any existing medical conditions to ensure appropriate coverage. Some policies may exclude coverage for pre-existing conditions unless a waiver is obtained. Finally, compare quotes from various insurers to find the best balance of coverage and cost. Don’t hesitate to contact insurers directly to clarify any questions you may have.

Tips for Making a Smooth Claim

Filing a travel insurance claim can sometimes feel daunting, but these tips can help streamline the process. Keep meticulous records of all your travel documents, including your itinerary, booking confirmations, and receipts for any expenses incurred. This organized documentation will be crucial when substantiating your claim.

Contact your insurance provider as soon as possible after an incident occurs. Prompt communication allows them to guide you through the necessary steps and provide specific instructions for your situation. Be prepared to provide a detailed account of the event, including dates, times, and locations.

Understand your policy coverage. Familiarize yourself with the specific terms and conditions of your policy to understand what is and isn’t covered. Pay close attention to the claims filing deadline as missing it can invalidate your claim. Be sure to cooperate fully with the insurer’s requests for information and documentation.

Keep copies of all communication, including emails, letters, and claim forms. This documentation can be valuable if any discrepancies arise during the claims process. While a smooth claims process is ideal, being prepared and informed can significantly reduce potential stress and ensure a more efficient resolution.